OPEN ENROLLMENT HIGHLIGHTS for 2024

- Open enrollment will be November 6th – November 24th, with all changes effective January 1, 2024

- All full-time and part time (30+) employees must complete open enrollment even if no changes are being made

Medical Plans for 2024

Throughout 2023, with the assistance of Marshall & Sterling, we researched several medical and pharmacy providers in our markets. After much consideration, we have decided to partner with new providers.

Effective January 1, 2024, our self-insured medical plans will transition to Empire Blue Cross (soon to be named Anthem Blue Cross) and our pharmacy plan to Meritain.

With the rising cost of medical care/services and the continued growth of our employee population, we have reviewed our medical plans to tailor them to fit the diverse lifestyles and needs of our employees.

For 2024, Curtis Lumber will offer three plans to current employees: Hybrid, HSA, and Copay (only if currently enrolled, no new Copay enrollments). Please find plan highlights below.

Hybrid Plan

Plan Highlights:

- Rates have been decreased for 2024

- Upfront deductible on all services other than preventative

- Deductible of $500 for single and $1,000 for double and family coverage

- Once the deductible is met, copays will apply

- This plan is not eligible for a Health Savings Account (HSA)

Copays after Deductible (most utilized):

- Primary Care: $20

- Specialist: $50

- Urgent Care: $35

- Emergency Room: $150

Weekly Rates:

Single: $59.02/$50.17 (Wellness)

Double: $118.04/$100.34 (Wellness)

Family $153.46/$130.44 (Wellness)

High Deductible Plan with HSA

Plan Highlights:

- Rates have been decreased for 2024

- Upfront deductible on all services other than preventative

- Deductible of $1,750 for single and $3,500 for double and family

- Once the deductible is met, copays will apply

- This plan is paired with a Health Savings Account (HSA)

Health Savings Account (HSA)

- Tax-advantage member owned accounts that let you save pre-tax dollars for future qualified medical expenses.

- Employees can contribute to their HSA on a weekly basis through payroll (This is highly encouraged).

- Curtis Lumber will contribute 50% of your deductible: single will receive $875, and double & family will receive $1,750. On January 1st: Single will receive $437.50 and $39.77 the first of each month for the remainder of the year; Double & Family will receive $875.00 and $79.55 the first of each month for the remainder of the year. That’s right! Curtis Lumber is giving you money!

- HSA account balances roll over each year allowing you to accumulate savings for medical related expenses. If you leave Curtis Lumber, your HSA goes with you.

- Invest your HSA funds once a certain account balance is met.

- Put the extra money you would pay for the copay plan into your HSA – pay yourself, not the insurance company.

Copays after Deductible (most utilized):

- Primary Care: $10.00

- Specialist: $40.00

- Urgent Care: $35.00

- Emergency Room: $150.00

Weekly Rates:

Single: $50.92/$42.27 (Wellness)

Double: $101.85/$84.53(Wellness)

Family: $129.78/$107.72 (Wellness)

Understanding Health Savings Accounts (HSA) Video: HSA 101

Copay Plan

Plan Highlights:

- Rates have been decreased for 2024

- Only employees that are currently enrolled are eligible; no new enrollment

- No deductibles apply, set copay per treatment and services

Copays (most utilized):

- Primary Care: $20.00

- Specialist: $50.00

- Urgent Care: $50.00

- Emergency Room: $250.00

Weekly Rates:

Single: $72.61/$63.17 (Wellness)

Double: $145.21/$126.33 (Wellness)

Family: $188.77/$164.23 (Wellness)

Medical Plan FAQs

What is a deductible?

- It is money you pay out of your pocket for medical treatment, services and prescriptions prior to Anthem Blue Cross paying your claim.

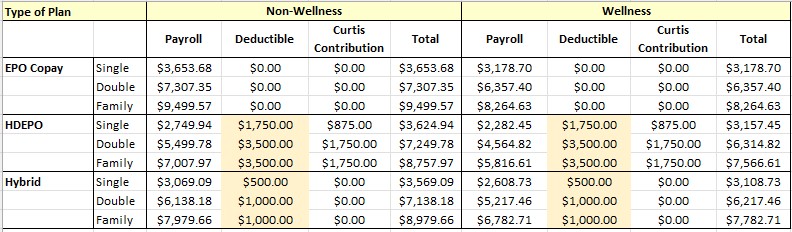

What is my Annual Employee Investment?

Which Plan is the Best Fit for You?

When selecting a medical plan that best fits you and your family, below are some questions to think about:

- Do you or anyone on your plan see a doctor regularly (i.e. primary care, specialist, chiropractor, physical therapist or psychologist)?

- If yes: are the visits monthly, quarterly or annually?

- Do you or anyone on your plan take prescription medication regularly?

- If yes: what is the actual cost of the medication?

If you answered “No” to the above: The High Deductible Plan with HSA could be a great fit for you.

If you answered “Yes” to the above: for example, you take a monthly prescription medicine that is $12.00, and you see a chiropractor annually (estimated $250). The Hybrid Plan could suit you best.

If you answered “Yes” to the above: for example, both you and your spouse have multiple monthly prescriptions (estimated $150), you see a psychologist monthly (estimated $250 each), and your spouse sees a specialist quarterly (estimated $250 each). The Copay Plan may be the best plan, if eligible.

What services are considered Preventative Care?

- Adult Physicals

- Well Childcare & Immunizations

- Mammography

- Annual Pap Test & Ob/Gyn Exam

- Immunizations for Adults

- Colonoscopy & Sigmoidoscopy Screening for Adults

- Bone Density Tests

How much do I pay for Preventative Care?

- Preventative Care is covered in full – No deductibles or copays apply

How can I reduce the cost of my medical coverage?

- Participate in the Curtis Lumber Wellness Program (see details below)

- Review annual employee investment

- Consider alternate plans – different rates for each available plan

Wellness

Get your wellness activities in as soon as you can to get your wellness discount!!

- Annual Physical

- Two elective activities: such as dental cleaning, eye exam, vaccine, cancer screen, etc.

- If your spouse is on your medical plan they must also complete activities

Send proof of activities to MS Wellness mswellness@marshallsterling.com

Other Voluntary Benefits

Dental

Plan Highlights:

- No changes, rates have not increased for 2024

- Coverage is available for preventative, basic and major services

- $1,000 in coverage per person per year covered under the plan

- Orthodontia coverage available for dependent children ($1,000 lifetime max per child)

Weekly Rates:

Single: $6.34

Family: $17.13

Ortho: $19.75

Vision

Plan Highlights:

- No changes, rates have not increased for 2024

- Two options: Davis (big box retailers) and VSP (private/smaller offices)

- Eye exam available every 12 months

- Lenses for glasses or contacts available every 12 months, frames every 24 months

Weekly Rates:

Davis

Single: $1.42

Family: $3.06

VSP

Single: $1.85

Family: $3.96

Accident

Plan Highlights:

- No changes, rates have not increased for 2024

- Cash benefit for covered injuries, treatment and services

- This plan would pair well with the HSA and Hybrid medical plans

Weekly Rates:

Single: $2.85

Double: $4.65

Family: $6.49

Specified Disease

Plan Highlights:

- No changes, rates have not increased for 2024

- A cash benefit for a range of covered serious illness including: cancer, stroke, heart attack

- Employee: $10,000; Spouse: $5,000 and Child: $2,500

- This plan would pair well with the HSA and Hybrid medical plans

Rates vary depending on age and coverage type.

ID Watchdog

Plan Highlights:

- No changes, rates have not increased for 2024

- Identity theft protection program monitors credit reports, social media, transaction records, public records and more

Weekly Rates:

Single: $2.52

Family: $4.36

Short Term Disability

Plan Highlights:

- No changes, rates have not increased for 2024

- Weekly payroll deductions may increase on January 1st based on age and income levels

- Coordinates with state disability to pay 60% of salary if out of work due to illness, injury or medical condition

- If not currently enrolled, a health questionnaire must be completed, and coverage must be approved by Guardian prior to enrolling. Do not enroll during open enrollment, contact Lisa Yorks for forms.

Rates vary depending on age and coverage amount.

Life Insurance

Plan Highlights:

- No changes, rates have no increased for 2024

- Weekly payroll deductions may increase on January 1st based on age and income levels

- Available for employee, spouse, and children, offered in $10,000 increments

- If not currently enrolled, a health questionnaire must be completed, and coverage must be approved by Guardian prior to enrolling. Do not enroll during open enrollment, contact Lisa Yorks for forms.

Rates vary depending on age and coverage amount.

For full benefit summaries go to either:

- Your Kronos profile – My Company – Documents

- CurtisDocs – Human Resources Folder

GET STARTED WITH OPEN ENROLLMENT 2024

Open enrollment will begin on 11/6/23 and must be completed by 11/24/23.

Failure to complete open enrollment will result in a loss of benefits.

Your current benefits will already be selected. Review, make any necessary changes, and then submit!

To begin open enrollment, login to Kronos below and then follow the open enrollment wizard to make your benefit selections.

Your username is your first initial last name, i.e. jdoe

To reset your password, follow the prompts.

Once in Kronos go to My Info – My Benefits – Enrollment – Start Open Enrollment

If you have any questions please reach out to Lisa Yorks in HR at 518-490-1388 or Lisa.Yorks@curtislumber.com